ETS updates FCA bonds transparency tables to show non-cumulative % for trade/volume against thresholds

ETS has updated its summary on the FCA’s new bond transparency rules to show the estimated non-cumulative % for trade and volume captured within the new thresholds.

(You can download the summary of the UK’s new bonds transparency regime, with the updated tables, as a PDF here: The UK’s New Transparency Regime for Bonds.pdf)

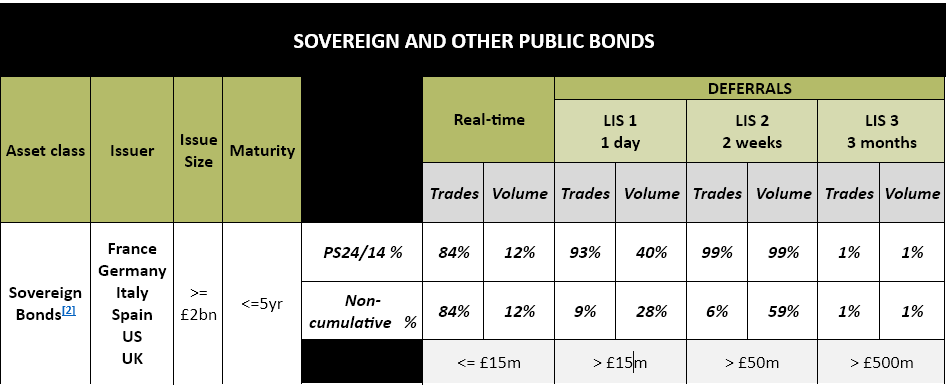

In PS 24/14, page 44, table 9 (Impact on Transparency), the FCA shows the cumulative % of estimated trade/ volume captured from left to right. In sum, FCA’s table 9 shows the following:

- the non-cumulative % captured in real-time;

- the cumulative % for ‘real-time + LIS 1’ in LIS 1;

- the cumulative % for ‘real-time + LIS 1 + LIS 2’ in LIS 2;

with the % in LIS 3 bringing the total to 100%.

To illustrate the above, the below table shows the values shown in PS 24/14 (see ‘PS24/14 %’ row) and the calculated non-cumulative values (see ‘non-cumulative %’ row), for sovereign bonds with issuance size =/over £2bn and maturity less than/= to 5 years.

The UK’s New Transparency Regime for Bonds

Key points from FCA Policy Statement on improving transparency for bond markets

Etrading Software (ETS) is an independent, global provider of technology-led solutions built to address highly complex and constantly evolving market and regulatory challenges. With a 20-year track record, ETS specialises in the provision of market and reference data used by international financial institutions. The Group has offices in Europe and Asia, with headquarters in London.

Introduction

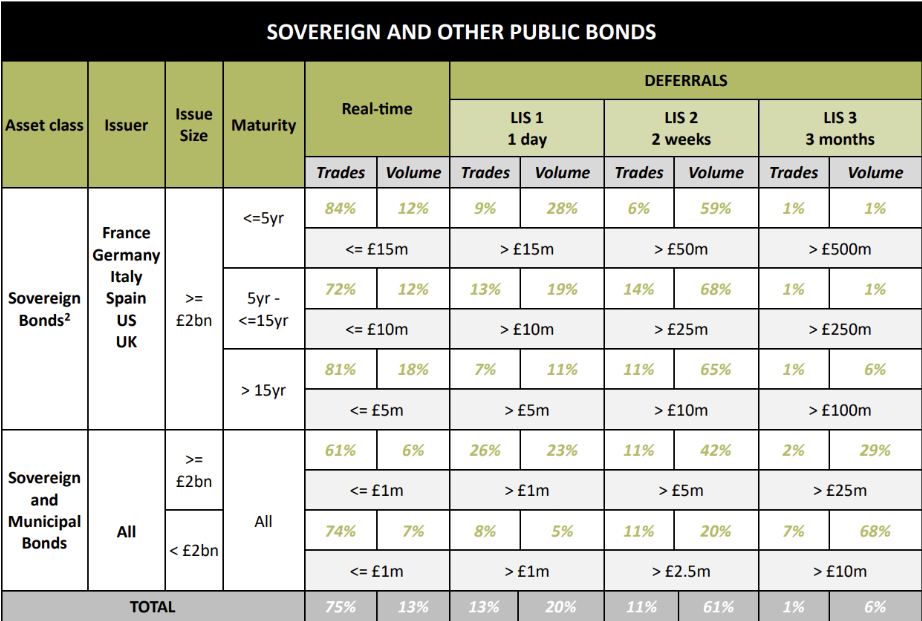

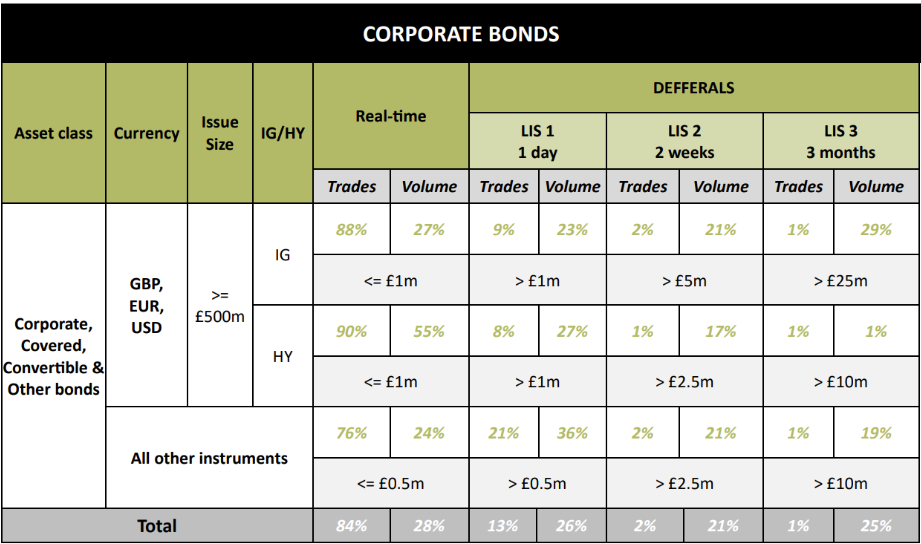

This article provides a summary of the FCA’s recently published new rules (PS 24/14[1]) to revamp the UK’s bonds transparency regime, which are set to apply from 1 December 2025. The calibration of the transparency regime is also captured in two handy tables showing the final thresholds including the FCA’s estimate of trade and volume percentages within each threshold.

Redesigning the regime

The transparency scope continues to apply to all bonds traded on a UK trading venue (TOTV). However, going forward, instead of performing transparency calculations, the FCA will use a set of features considered reliable proxies for a bond’s liquidity: these are (i) type of issuer (sovereign or corporate); (ii) country of issuer; (iii) issuance size; (iv) time to maturity; (v) currency of issuance; and (vi) credit rating (investment grade (IG) or high yield (HY)). Consequently, the FCA will discontinue its transparency calculation system, Financial Instruments Transparency System (FITRS).

Pre-trade transparency will only apply to trading venues in respect of the following trading systems: continuous auction order books, quote-driven trading systems and periodic auction trading systems. Investment firms will no longer be subject to pre-trade transparency for trading bonds OTC. Further, from 31 March 2025, trading venues and will no longer need to apply pre-trade transparency to voice and RFQ trading and systematic internalisers will not need to make public quotes ahead of the start of the new regime in December 2025.

For post-trade transparency, real timereporting means as soon as technically possible and no later than 5 minutes from execution. Package transactions and portfolio trades have a longer maximum real time reporting definition of 15 minutes, due to the potential for operational complexities in reporting.

The FCA has recalibrated the transparency thresholds with three post-trade LIS thresholds and deferral durations. For pre-trade, an LIS waiver will be set at the same level for each instrument as the LIS 2 threshold applicable to it for post-trade deferrals.

Timeline

The FCA will select the UK bond consolidated tape provider (CTP) in H1 2025. The new rules start from 1 December 2025 and the CTP is expected to go live shortly thereafter.

UK Transparency Thresholds

No Comments